BABA arrives at Fiber Connect

Build America, Buy America (BABA) purchasing requirements are an essential part of the $42.45 billion BEAD program, designed to “onshore” and create broadband manufacturing capabilities and jobs for the United States as materials and equipment are purchased for the construction of networks across the country. BABA provisions were top of mind for most Fiber Connect participants, including federal officials, service providers planning to build networks with BEAD money, and equipment manufacturers.

“The goal for President Biden and the Congress is ensuring that this money is spent on products made by American workers,” William Arbuckle, Policy Advisor, NTIA, U.S. Department of Commerce told Fiber Connect attendees in his keynote address. “That’s sort of the crux of it, that infrastructure money, in every case or as many cases as possible, is spent on products made by American workers. The Buy America Act requires that all the iron, the steel, the manufactured products, the construction materials that are used in infrastructure projects and funded with federal dollars, and this includes the $42.45 BEAD grant program, are produced in the United States.”

Arbuckle said the starting point for BABA, or “Buy America” as he called it in his remarks, was that any project funded through the Bi-partisan Infrastructure Law (BIL) would have to have “the vast majority of stuff” it used to be made in the U.S. “It’s easy enough to say that if it can be made in America, it should be made in America. And that is our broad commitment,” said Arbuckle. “But we know that the reality is often more complex.”

NTIA’s William Arbuckle outlining BEAD’s Build America, Buy America requirements at Fiber Connect 2023. (Source: Doug Mohney)

NTIA has been conducting a supply chain analysis for BEAD deployments, mapping out the jobs that will be created, who makes the equipment involved and where it is made, and the ramifications of making any particular piece of equipment in the U.S., including the time, cost, and commercial feasibility of manufacturing within the country. Arbuckle and his team held nearly 250 distinct meetings with different teams to understand the logistical challenges of complying with BABA.

“Two years ago, we heard concerns about the lack of availability of electronics that would be compliant with the Buy America preference, and specifically how the integrated circuits are almost uniformly made in Southeast Asia,” said Arbuckle. “This was something that we heard about, conversation after conversation, if you’re going to move electronics to the U.S., we have this big challenge, especially around the circuits.”

Arbuckle discussed NTIA’s proposed BABA waiver, released the day before his keynote, and its impact and necessity in striking a “firm, but also pragmatic balance” to expand domestic manufacturing and leading to jobs creation in the U.S. while ensuring that high-speed broadband networks are built in a timely manner.

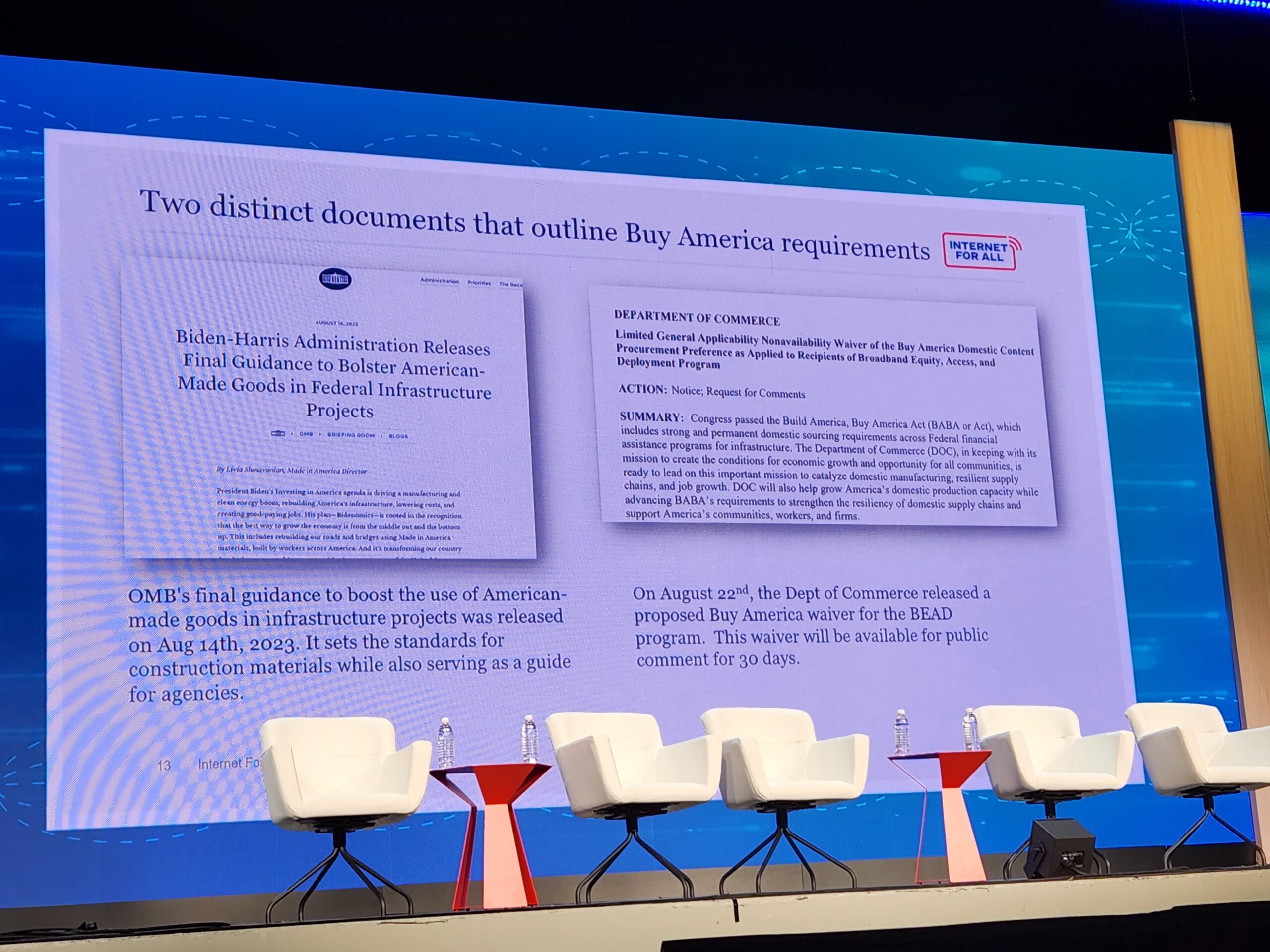

There are two distinct documents that apply to BABA provisions, one final document from the Office of Management and Budget (OMB) that is designed to boost the use of American-made goods and sets a standard for construction materials. “If you are determined to be a construction material, you need to be made in the U.S.,” said Arbuckle. Optical fiber is defined as construction material, with a targeted narrow waiver for non-optic glass inputs which can be used as an input to the preform material.

Build America Buy America provisions are described in OMB and Department of Commerce directives. (Source: Doug Mohney)

The second document is the proposed NTIA waiver, which provides specific guidance for the BEAD program, with descriptions of what materials and good will won’t be accepted for purchase, including the complexity of figuring out how to handle electronics gear.

“When it comes to electronics, we found that there’s some classes and categories of electronics that are currently manufactured outside of the United States, but for which there is an economic case for onshoring the assembly,” said Arbuckle. “What we’ve done at NTIA is we propose to waive all electronics for the BEAD program, with the exception of four categories of electronics.”

Optical line terminals (OLTs), OLT line cards, optical pluggables that are used for OLTs, and optical network terminals (ONTs/ONUs) being purchased with BEAD funding all will have to be made in the United States. NTIA is providing specific guidance as to the manufacturing process that must occur in the U.S. for those four categories to be BABA-compliant, with a two-part test to be applied. The first part is if the item was manufactured in the United States. The second part is if the components of the product equal a 55% domestic content threshold, with one caveat.

“We heard though, from many of you, that the integrated circuits or chips in this equipment makes up the majority of the value of these components,” said Arbuckle. “While the Biden-Harris Administration is deeply engaged in efforts to bring back semiconductor manufacturing to the U.S., we have determined that for the time being, we’re going to waive that 55% component test. To reiterate, electronics need to be made in the U.S. We’re waiving that second test around the 55% domestic content threshold, and that’s due to the difficulty of sourcing those integrated circuits.”

In addition, each BEAD project will have the opportunity to apply for a De Minimis waiver for certain items, such as lashing wire and other materials of what Arbuckle described as a “catch all category of other network equipment” to make sure network builders have some flexibility to meet deployment goals and budget. Enclosures and electronics are exempt from the De Minimis waiver, and must be made in the U.S.

The final version of the NTIA BABA waiver policy should be available this fall once adjustments are made from the comments period that ended on September 21, 2023.

“Last but not least, under this Buy America approach, based on the analysis that we do when we estimate that on a per project basis, we think that close to 90% of BEAD equipment spend will be on American made products and materials,” said Arbuckle. “That means more good jobs, domestically, more successful local businesses and as we saw during COVID, a more resilient domestic supply chain. That is what this [NTIA] rule set is designed to develop.”

Arbuckle noted that a number of network companies were increasing their U.S.-based manufacturing in response to BEAD BABA requirements. “I was in Hickory, North Carolina, several months ago where Corning and CommScope announced an investment in their fiber optic cable facilities, hundreds of millions of dollars, hiring hundreds of workers,” he said. “We’ve gone to Jackson, Tennessee, to visit Prysmian. In the last month, we’ve been in Wisconsin where Nokia announced onshoring electronics. We were in Alabama where Adtran announced expanding manufacturing and onshoring. We are seeing companies step up and I would say I am very confident that there are more companies that are going to be announcing domestic manufacturing expansion onshore in the near future. This is not ‘pie in the sky’ thinking. We are seeing companies stepping up and beginning to improve their supply chains.”