North American Fiber Growth Hits Highest Annual Record

Last year, fiber broadband hit all new records, with 9 million newly passed U.S. homes added by network operators in 2023, of which 6 million of those newly passed homes previously did not have fiber, according to the latest annual research conducted by RVA LLC Market Research & Consulting (RVA) for the Fiber Broadband Association (FBA).

“Cumulatively we’re now at about 78 million homes past, including second and third passings,” said Michael Render, CEO and Principal Analyst, RVA LLC Market Research and Consulting, as he presented the research during a December 2023 Fiber for Breakfast webinar. “We’re at about 69 million unique homes passed. We’re now passing 51.5% of U.S. households, unique primary homes.”

Fiber broadband also passes a growing percentage of second homes or short-term rentals. RVA estimates the total available market remaining for FTTH may be over 100 million homes including second and third passings in many areas, and there is likely a decade of deployment at or above the current momentum.

There are now 30.9 U.S. million homes “connected” by fiber, with the take rate over the last year on the increase. “We’ve dipped a bit in the past, but we’re on the rise again to about 45.4% in average,” said Render. “Some companies are showing in their public information that their first year take rate is really improving.” Render citied public statements and data from larger service providers where recent take rates have significantly increased, with AT&T reporting new builds are achieving double the take-rate when compared to historic data, while both Consolidated and Windstream have inferred take-rate increases of over three times for 2023 builds.

“We’ve known for years that the benefits of fiber outweigh any other broadband technology available, but it is always refreshing to have this annual survey validate those facts,” said Deborah Kish, Vice President of Research and Workforce Development at the Fiber Broadband Association. “Year after year, our research demonstrates the growing preference for fiber and the increased success of the fiber broadband ecosystem in extending the reach of high-quality broadband networks.”

Healthy fiber progress has been observed in Canada as well. Overall Canadian passings had 12% growth in 2023 to 12.1 million. Fiber now passes 11.2 million unique Canadian homes and fiber uptake in Canada is estimated at 44.6% (including incumbent providers and CLEC providers utilizing fiber installed by others). “Of course, it gets tougher from here in Canada, because of the rural nature of much of the country,” Render stated.

RVA analyzed multiple sources of data to arrive at its 2023 numbers, including public company data, the FBA/RVA 2023 surveys of mid-size and smaller providers, data from the FBA/RVA 2023 Consumer Study, review of the 2023 Federal Communications Commission (FCC) mapping data, data from other industry association surveys, and interviews and data from vendors and engineers.

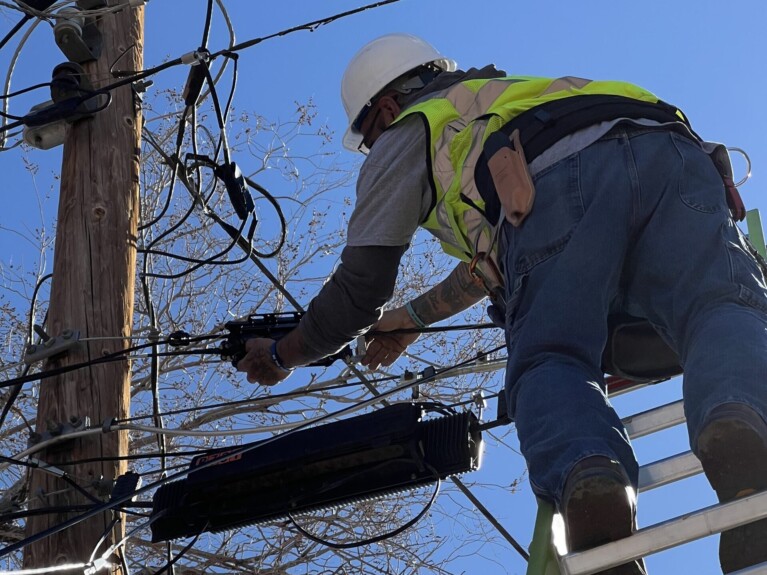

As the number of homes passed and homes connected with fiber have increased, so have the number and type of fiber providers delivering those services, especially with the growth of rural electric fiber broadband providers over the past five years. While their overall share of homes passed is currently the smallest at 2.2%, rural electric providers have quickly entered the fiber broadband market and now almost match homes passed by municipalities at 2.7%. Incumbent telephone tier 1 and derivative fiber providers still lead with 64.7% of homes passed; incumbent telephone tier 2 and 3 providers have 11.3% of homes passed; private competitive providers/CLECs have 9.9%; and MSO/Cable operators have 9.1%.

Assessing exactly how fast 2024’s growth will occur will take some time, between data collection and weather playing a factor in construction. “There’s some seasonality [to building],” said Render. “The slowest time is the first part of the year with cold weather-related issues. You reach your peak in the middle of the summer.”

However, there were some hiccups to 2023 as well, with the stock price of fiber-related equipment manufacturers dropping to about 40% of their value over the course of the year. “It’s an inventory correction factor coming into play,” said Render. “There was a huge bubble at the end of 2021 and through 2022 as companies were concerned about supply shortages. People were building up to try to make sure they had the inventory they needed in their warehouses to go forward. But they overdid it a bit. And then interest rates went up and Wall Street said they needed to get inventories down.”

Render believes the fiber ecosystem is close to reaching equilibrium between supply and demand, as companies reduce their inventories back to pre-pandemic levels. “It could be turning around now, or it could be the first part of the year,” he said. “It depends on the type of vendor since there are differences in the supply chain for fiber cable manufacturers versus outside plant enclosures and so forth. I also think some service providers are realizing there is an opportunity to build while they have workforce available before all that additional government money hits, so I expect deployment to turn up even further in 2024. Those two things could connect quickly.”

Small to mid-sized service providers faced their own challenges in 2023, with labor availability quality rating the highest at 24% among respondents in an RVA survey conducted earlier in the year, followed by rapidly rising construction costs (18%), materials concerns (15%) and permitting (8%). “There are concerns out there,” said Render. “The Fiber Broadband Association is the association working on all of these concerns and smoothing the road going forward.”

Private funding is expected to play a key role in 2024 fiber expansion, with numerous investment firms putting money into telecommunication infrastructure projects. “There’s been a huge realization that for every dollar of fiber, the valuation is much higher than other kinds of internet,” said Render. “People have seen the opportunity to get a very solid return on their investment, whether they continue to operate it or eventually they’ll be flipping companies and consolidating companies.”

When asked what 2024 growth will look like, Render did not have a specific number to provide, but felt the trends were good. “This is the time of year where we do our forecast report,” Render stated. “I think it will definitely be in the range of [2023’s growth of 9 million homes]. Most people think it will be later, 2024 or even 2025 before the BEAD money starts flowing in a big way. But there’s other government money out there and all this private money, so we need to analyze that carefully. But barring some geopolitical economic catastrophe, we expect the numbers to increase next year.”